If you want to grow your business, you need to know how much it costs to bring in a new customer.That number is your Customer Acquisition Cost (CAC), and it's one of the most important metrics you can track.

The basic customer acquisition cost calculation is pretty straightforward: take your total sales and marketing costs for a specific period and divide that by the number of new customers you won in that same timeframe. Simple, right? But the implications of that number are huge. It’s a direct pulse check on your company's financial health and scalability.

Why Customer Acquisition Cost Is a Critical Metric

Nailing down your CAC isn't just a bean-counting exercise for the finance team. It’s a strategic necessity that really dictates whether you can grow profitably. If you don't have a firm handle on this number, you're flying blind. You have no real way of knowing if your marketing efforts are actually making you money or just burning through your budget.

Ultimately, CAC answers the most critical question for any business: "Is our growth sustainable?"

In a world where ad costs seem to only go up and competition is everywhere, getting a precise CAC calculation helps you do a few key things:

- Optimize Your Marketing Spend: Once you know which channels bring in customers most affordably, you can double down on what's working and cut the campaigns that are bleeding you dry.

- Set Realistic Growth Goals: Your CAC is directly tied to your profitability per customer. That, in turn, defines how fast you can scale without having to chase down investors for more cash.

- Improve Your Business Model: A consistently high CAC can be a red flag. It might point to problems with your pricing, your targeting, or even your sales process, pushing you to make changes that ensure you're still in business next year.

The Rising Cost of Acquiring Customers

Let's be honest—it's getting tougher out there. Over the past five years, average customer acquisition costs have shot up by a staggering 60%, completely changing the game for marketers.

This spike is a perfect storm of more digital ad competition, new privacy rules making targeting harder, and a general saturation across major channels. For an ecommerce brand, the cost now averages around $70 to get a single new customer. When numbers get that high, efficiency isn't just a goal; it's a survival tactic.

Think of your CAC as a financial GPS for your growth strategy. It shows you where you are, but more importantly, it tells you if the road you're on leads to profit or a dead end.

Distinguishing CAC from CPL

It's easy to mix up CAC with Cost Per Lead (CPL), but they measure two very different things.

CPL is the cost of getting someone to raise their hand and show interest—they become a lead. CAC, on the other hand, is the cost to turn that lead into an actual paying customer. You absolutely need to understand both to get a full picture of your marketing funnel.

We break this down even further in our guide on what cost per lead truly means. Getting this distinction right is the first step toward a more accurate and insightful customer acquisition cost calculation.

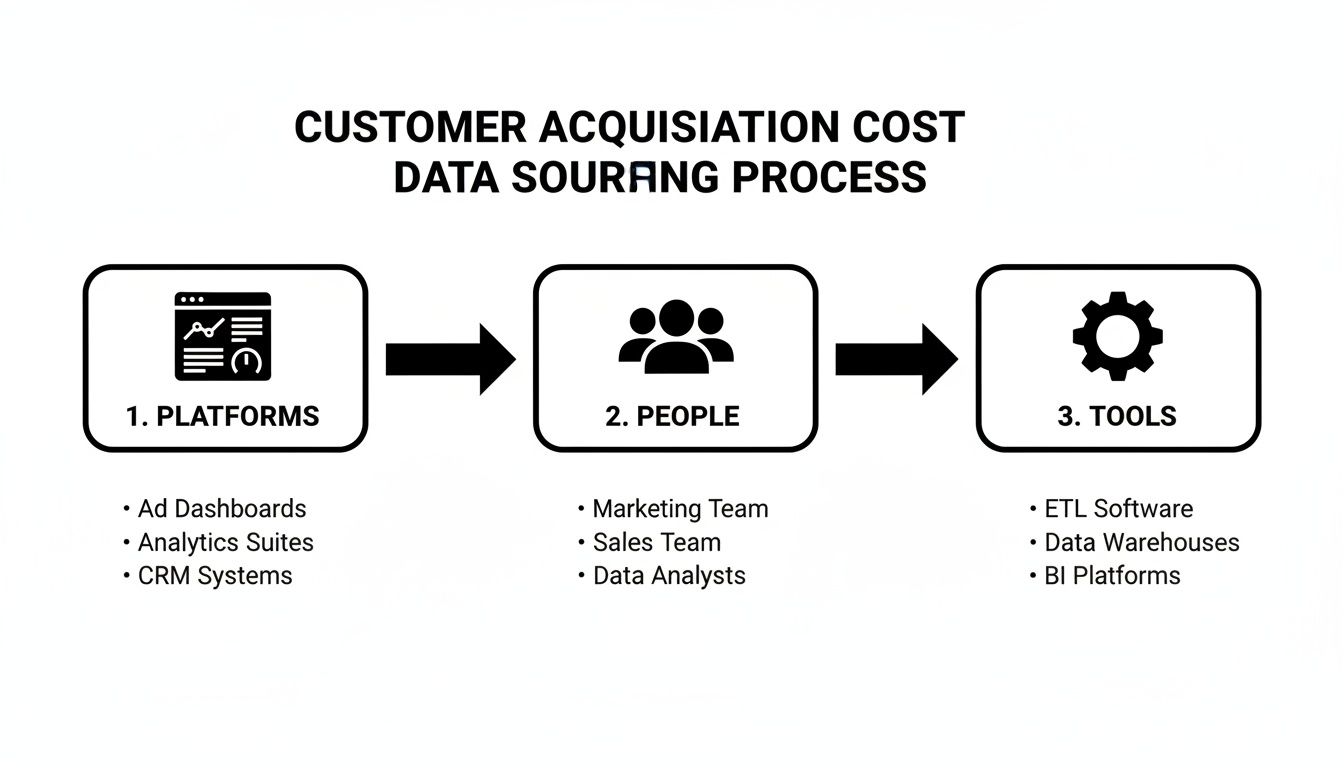

Finding the Right Data for Your CAC Calculation

An accurate customer acquisition cost is only as good as the data you feed it. The old "garbage in, garbage out" saying has never been more true. To get a number you can actually trust, you have to put on your data detective hat and pull information from a few different corners of your business.

This isn't just about grabbing your total ad spend. It’s about building a complete picture of every single dollar that goes into winning a new customer.

Gathering Your Core Sales and Marketing Costs

Let's start with the most obvious costs—the ones that are usually easiest to find. Think of these as the direct expenses tied to your sales and marketing efforts. Most of this information lives in the platforms you already use every day.

You'll want to pull data from a few key places:

- Ad Platform Dashboards: This is ground zero. Get your total ad spend from Meta Ads Manager, Google Ads, TikTok Ads, or any other platform where you're running paid campaigns.

- CRM and Sales Software: Your CRM, whether it's HubSpot or Salesforce, is where you'll find data on sales team commissions, bonuses, and any performance-based pay directly linked to closing new deals.

- Accounting Software: Tools like QuickBooks or Xero are your source of truth for all recorded expenses. Look here for payments to marketing agencies, freelance copywriters, content creators, and other contractors.

Uncovering the Often-Missed Expenses

Here's where many businesses get it wrong. Just adding up your ad spend and sales commissions will give you an incomplete—and dangerously low—CAC. True accuracy comes from digging a layer deeper and including all the indirect costs that support your acquisition machine.

These less obvious, but absolutely critical, costs include things like:

- Team Salaries: The salaries of your marketing and sales team members absolutely count. A common approach is to allocate a percentage of their salary based on how much time they spend on customer acquisition activities.

- Software and Tool Subscriptions: What about the monthly fees for your email marketing platform, SEO tools, analytics software, or your CRM itself? These are all part of the cost of acquiring customers and need to be in the calculation.

Capturing the full cost is non-negotiable for a true customer acquisition cost calculation. A blended CAC that omits salaries and software costs isn't just inaccurate—it's misleading and can lead to poor budget decisions.

For example, your social media manager’s salary is an acquisition cost. That subscription for your landing page builder? That’s an acquisition cost, too. Even the analytics tools you use to track performance are part of the overall expense.

To accurately measure the effectiveness of your Meta campaigns, for instance, you need solid tracking in place. If you need a refresher, check out our guide on how to set up the Facebook Pixel to make sure your data foundation is strong.

By pulling all these numbers together, you move from a vague estimate to a sharp, actionable metric that reflects the true investment required to grow your customer base.

Getting Your Hands Dirty: Calculating CAC with Real Business Examples

Alright, let's move past the theory. The real power of the customer acquisition cost calculation comes alive when you apply it to your own numbers. We'll walk through a few practical scenarios that mirror common business models, giving you a solid template to work from.

The formula itself is simple: Total Sales & Marketing Costs / New Customers Acquired = CAC. The trick, as always, is in the details—specifically, making sure you've accounted for all the relevant costs.

To get this right, you need to pull data from a few different places. It's not just about your ad spend. You have to factor in the people running the campaigns and the software that supports them.

This holistic view is crucial. If you only look at ad spend, you're getting a dangerously incomplete picture. Salaries and software subscriptions are real costs of acquisition, and including them is the only way to get a CAC figure you can actually trust.

B2B SaaS Company Example

Let's start with a B2B SaaS company that just wrapped up a big growth quarter. Their sales cycle is on the longer side, involving multiple demos and a hands-on sales team.

Here’s what their quarterly expenses looked like:

- Marketing Team Salaries: $45,000

- Sales Team Salaries & Commissions: $75,000

- Google Ads & LinkedIn Ads Spend: $50,000

- Content Creation (Freelancers): $10,000

- Marketing & Sales Software (CRM, Analytics): $5,000

Add that all up, and their total acquisition cost for the quarter comes to $185,000. In that same period, they brought on 250 new enterprise clients.

The math is straightforward: $185,000 / 250 = $740 CAC. Now they know it costs them $740 to land a new enterprise customer. This is the number they’ll measure against their customer lifetime value (LTV) to see if their growth engine is truly profitable.

DTC E-commerce Brand Example

Next up, a direct-to-consumer (DTC) e-commerce brand that went all-in on a campaign last May. Their business lives and dies by paid social and influencer collaborations.

Here's their cost breakdown for the month:

- Meta Ads (Facebook & Instagram): $30,000

- TikTok Ads: $15,000

- Influencer Marketing Fees: $10,000

- Email Marketing Platform: $1,000

- Marketing Manager Salary (Portion for acquisition): $4,000

Their total spend for May was $60,000, which brought in 1,500 new customers.

So, the calculation is: $60,000 / 1,500 = $40 CAC. This brand now has a clear benchmark: they spend $40 to get a new buyer. They can immediately compare that to their average order value to check if their campaigns are profitable from the very first purchase. If you want to dig deeper into these kinds of expenses, check out our guide on the true costs of advertising online.

Channel-Specific CAC for Meta Ads

Finally, let's zoom in and isolate a single channel. Imagine a mobile app company trying to figure out the true CAC from their Meta Ads campaigns last month. This is where things get really actionable.

Calculating channel-specific CAC is essential for smart budget allocation. It helps you identify your most efficient channels and scale them, rather than relying on a blended, less-actionable average.

Here are the costs tied only to their Meta Ads activity:

- Total Meta Ad Spend: $20,000

- Creative Production (Designer Fee for Ads): $2,500

- Social Media Manager Salary (Portion for Meta Ads): $1,500

The total channel-specific cost is $24,000. Looking at their Meta Ads dashboard, they can see these campaigns drove 800 new app subscribers.

The calculation is: $24,000 / 800 = $30 CAC. This laser-focused metric gives them a powerful insight: Meta is a highly efficient channel, bringing in new subscribers for just $30 a pop. Now they can confidently decide whether to double down on that channel or optimize other, less efficient ones.

Going Beyond the Basic CAC Formula

Calculating your overall customer acquisition cost is a fantastic start, but it's like looking at your business through a blurry lens. A single, blended CAC lumps your most profitable marketing channels in with your least effective ones, hiding the real story.

To make genuinely smart decisions, you need to bring that picture into focus. This is where high-growth companies separate themselves from the pack. They move beyond a static number and turn CAC into a dynamic tool for digging into what's really working—and what's secretly draining the budget.

Segmenting CAC by Marketing Channel

Let's be real: not all customers are acquired equally. Someone who finds you through an organic search has a totally different cost profile than someone who clicks on a Meta ad. Lumping them together is a rookie mistake that masks valuable insights.

The fix? Calculate a channel-specific CAC. This just means isolating all the costs tied to a single channel and dividing them by the new customers you got only from that channel.

For example, to get your true Meta Ads CAC, you’d need to tally up:

- Direct Ad Spend: The total amount you actually paid Meta for your campaigns.

- Creative Costs: Any fees for designers, copywriters, or video editors who produced the ads.

- Associated Salaries: A portion of the salaries for the team members managing your Meta campaigns.

- Tool Subscriptions: The cost of any software used specifically for Meta ad management or analytics.

Once you do this for each of your major channels—Google Ads, email, content marketing, you name it—you can compare their efficiency head-to-head. You might find your Meta Ads CAC is a lean $35 while your Google Ads CAC is a hefty $70. Just like that, you know exactly where to shift your budget for better returns.

Tracking Acquisition Efficiency with Cohort Analysis

Another powerful move is cohort analysis. Don't let the name intimidate you. A cohort is just a group of customers who signed up during the same period, like "January 2024 Customers" or "Q3 Customers."

Calculating CAC for each cohort lets you see how your acquisition efficiency changes over time. Was your January cohort cheaper to acquire than your February one? If so, you need to know why. Maybe you ran a killer campaign in January, or perhaps ad costs spiked in February. This is how you spot trends and measure the real impact of your marketing experiments.

A rising CAC across several cohorts is a major red flag. It could signal ad fatigue, new competition, or that your campaigns are losing their punch. Catching this early gives you a chance to investigate before it tanks your profitability.

Adjusting for Real-World Complexities

Finally, a truly accurate CAC has to account for the messy realities of business—namely, returns and refunds. If your e-commerce brand acquires 100 customers but 10 of them return their products for a full refund, you didn't really acquire 100 customers. You acquired 90.

To get an honest number, you have to count only net new customers. The simplest way to do this is to subtract the number of customers who churned or returned within a specific window (say, 30 days) from your total new customers. This gives you a more conservative—and realistic—CAC that reflects your actual, sustained growth.

Linking CAC to Your Most Important Growth Metrics

Figuring out your Customer Acquisition Cost is a huge first step. But honestly, the number is almost meaningless by itself.

You only unlock its real power when you pair it with other key growth metrics. This is what gives you the full story of your business's health and scalability. Think of CAC as one instrument in an orchestra; you need to hear the others to understand the music.

Putting CAC in context transforms it from a simple expense report into a strategic tool for making smarter marketing and budget decisions. It’s how you find out if your growth is profitable and sustainable, or if it's all built on a shaky foundation.

The LTV to CAC Ratio: The Ultimate Health Check

The single most important relationship to get right is the LTV:CAC ratio.

This metric compares your Customer Lifetime Value (LTV)—the total revenue you can reasonably expect from a single customer—to what it cost you to get them in the door. It directly answers the question, "Are we spending our money wisely to acquire customers who will actually stick around?"

For any business to last, the value a customer brings in must be higher than the cost to acquire them. Way higher. While every industry has its own benchmarks, a healthy LTV:CAC ratio is widely considered to be 3:1.

- Below 1:1: You're actively losing money with every new customer. This is a five-alarm fire.

- Exactly 1:1: You're just breaking even on the acquisition, leaving zero room for operational costs, salaries, or profit. Not a viable business model.

- A 3:1 ratio: This is the sweet spot. It signals a profitable model with enough margin to cover other business costs and, crucially, reinvest in more growth.

Understanding different strategies to increase customer lifetime value is mission-critical, as it directly impacts how much you can sustainably afford to spend on CAC.

CAC Payback Period: How Fast Do You Recoup Costs?

Another metric that should be on your dashboard is the CAC Payback Period. This one is simple but powerful: it tells you exactly how many months it takes to earn back the money you spent to acquire a customer.

Why does this matter? A shorter payback period means healthier, more efficient cash flow. You can reinvest your marketing dollars faster, creating a powerful growth loop.

A long payback period, often anything over 12 months for SaaS models, can seriously strain your cash reserves. It slows down your growth potential, even if your LTV:CAC ratio looks great on paper.

ROAS: A Direct Link to Ad Profitability

Finally, it’s vital to connect the dots between CAC and Return on Ad Spend (ROAS). They're two sides of the same coin, but they give you different views. CAC tells you the cost to get a customer, while ROAS measures the gross revenue generated for every dollar spent on advertising.

ROAS provides immediate feedback on campaign performance, which is perfect for optimizing ad creative, audiences, and targeting in real-time. CAC gives you the bigger-picture, long-term view of business viability.

Monitoring both gives you a powerful combination: short-term campaign efficiency and long-term business sustainability. To get a handle on the campaign side of things, our guide explains how to calculate Return on Ad Spend for a clearer picture of profitability.

CAC and Its Strategic Partner Metrics

CAC is the star of the show, but it needs a strong supporting cast. Think of the following metrics as its strategic partners—each one provides a unique piece of the puzzle, helping you understand the full story of your growth engine. This table is a quick-reference guide to how they all work together.

| Partner Metric | What It Measures | The Ideal Relationship with CAC |

|---|---|---|

| LTV (Lifetime Value) | The total revenue you expect from a single customer over their lifetime. | The higher the LTV, the more you can sustainably spend on CAC. Aim for an LTV:CAC ratio of 3:1 or higher. |

| CAC Payback Period | The time (usually in months) it takes to earn back the cost of acquiring a customer. | A shorter payback period is better. It means faster cash flow and quicker reinvestment. Aim for < 12 months. |

| ROAS (Return on Ad Spend) | The gross revenue generated for every dollar spent on advertising. | ROAS is your real-time campaign health check. A strong ROAS on your paid channels directly contributes to a lower, healthier CAC. |

In the end, tracking these metrics alongside your Customer Acquisition Cost is what separates businesses that just spend money from those that invest it wisely. When you understand how these numbers influence each other, you're no longer just running ads—you're building a predictable, scalable, and profitable growth machine.

Actionable Strategies to Lower Your Customer Acquisition Cost

Knowing your numbers is only half the battle. The other half is actually improving them. Think of a high CAC not as a dead end, but as a bright, flashing signal that it’s time to optimize your strategy, sharpen your targeting, and get way more efficient with your marketing budget.

This is the part where your customer acquisition cost calculation transforms from a spreadsheet entry into real profit.

Lowering your CAC isn't just about slashing your budget. It’s about spending smarter. You want to squeeze the absolute most value out of every single dollar you put into growth, especially on a competitive battleground like Meta.

Master Your Ad Creative and Audience Targeting

On platforms like Facebook and Instagram, your ad creative is the single biggest lever you can pull. Generic ads get generic (and expensive) results. What you're looking for is that perfect marriage between a message that hits home and the exact audience segment that needs to hear it.

Of course, trying to manually test every possible combination of creative and audience is a recipe for burnout. This is where automation completely changes the game.

By automating your ad creation, you can spin up hundreds of variations in minutes. Test countless images, headlines, and audience interests all at once. This sheer volume of testing helps you find the winning combinations lightning-fast, letting you shift budget to your top performers and cut the dead weight.

For a deeper dive into practical methods, explore these actionable strategies to reduce your customer acquisition cost.

An optimized ad campaign isn't about finding one good ad. It's about building a system that consistently identifies and scales your best-performing creative and audience pairings, turning ad spend into a predictable growth engine.

Improve Your Website Conversion Rate

Driving traffic is only half the job. If your landing pages or checkout process are slow, confusing, or just don't feel trustworthy, you're lighting money on fire. Every click that bounces is just another number inflating your CAC.

Your main focus should be on creating a completely frictionless user experience.

- Optimize Page Speed: A tiny one-second delay in load time can tank your conversions by 7%. Your site needs to be blazing fast, especially on mobile.

- A/B Test Your Landing Pages: Never stop testing. Pit headlines, calls-to-action (CTAs), page layouts, and images against each other to find out what actually drives more sales or sign-ups.

- Add Social Proof: People trust other people. Weave in customer reviews, glowing testimonials, and detailed case studies to build credibility and nudge visitors toward converting.

Boosting your on-site conversion rate is one of the most powerful ways to lower CAC because it makes every ad dollar work that much harder. It's a critical step that’s often overlooked in the chase for a better customer acquisition cost calculation. And since many of these visitors start as leads, it's also worth revisiting our guide on cost per lead to see how the two metrics connect.

Ready to stop guessing and start scaling? With AdStellar AI, you can automate the entire ad creation and testing process on Meta. Launch hundreds of creative variations, let AI identify your top performers, and lower your customer acquisition cost without the manual grunt work. Start optimizing your Meta ads today.